Different Types Of Life Insurance

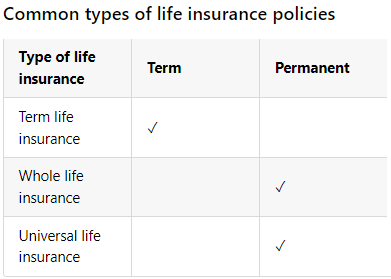

Common types of life insurance include:

- Term life insurance.

- Whole life insurance.

- Universal life insurance.

All types of life insurance fall under two main categories:

- Term life insurance. These policies last for a specific number of years and are suitable for most people. If you don’t die within the time frame specified in your policy, it expires with no payout.

- Permanent life insurance. These policies last your entire life and usually include a cash value component, which you can withdraw or borrow against while you’re still alive.

The Differences Between Term and Whole Life Insurance:

Term life insurance

How it works: Term life Insurance is typically sold in lengths of one, five, 10, 15, 20, 25, or 30 years. Coverage amounts vary depending on the policy but can go into the millions. “Level premium” term life insurance locks in the same price for the length of the policy. “Annual renewable” term life is a one-year policy that renews every year. Annual policies can be useful if you have short-term debts or need coverage for a brief period of time.

- Pros: It’s often the cheapest life insurance, and it's sufficient for most people.

- Cons: If you outlive your policy, your beneficiaries won’t receive a payout.

Whole Life Insurance

How it works: Whole Life Insurance typically lasts until your death, as long as you pay the premiums. It’s the closest thing to “set it and forget it” life insurance. In general, your premiums stay the same, you get a guaranteed rate of return on the policy’s cash value, and the death benefit amount doesn’t change.

- Pros: It covers you for your entire life and builds cash value.

- Cons: It’s typically more expensive than term life, so if you're looking for affordable life insurance, you might want to explore other options.

What’s best for you? Depends on your needs, your budget, and the purpose for buying the Life Insurance! A life insurance contract is a “love” contract; where one thinks of taking care of others if they are gone. The situation is the boss. All types of people have different needs, wants, and desires. There are some life insurance contracts we can create a Pension type income for life Tax - Free! Ask us about your complimentary analysis at no cost! We’ll review current coverages, or answer your questions. We can also make a tailored plan regarding your goals of coverage!

Source (NerdWallet, and Bruno E Pouliot CRPC, CKA)

Phone: (423) 326-5299 | Email: bpouliotcrpc@gmail.com

All Rights Reserved | Lion Of Judah Financial